Online capital gain calculator

Raja I have used capital gain calculator by simple tax India on my 14 years old house in my home town sold for Rs3000000- purchase for Rs 1716092- in 2005. Fisdoms capital gains calculator to get accurate tax liability.

Capital Gain Calculator Estimate The Tax Payable

Online Capital Gains Tax Calculator.

. So the current rate is. Sale of Virtual Digital Asset VDA including Cryptocurrency should not be considered as a capital gain starting from FY 2022-23 AY 2023-24 but should be treated as. As a result the.

September 11 2022 We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index. Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property. It calculates both Long Term.

In your case where capital gains from shares were 20000 and your total annual earnings were 69000. Tax brackets change slightly from year to year as the cost of living increases. From this date Capital Gains.

Calculate the Capital Gains Tax due on the sale of your asset. You pay no CGT on the first 12300 that you. There are some asset classes where you have the choice of using Indexation or not.

Calculate the Capital Gains Tax due on the sale of your asset. The tax rate you pay on long-term capital gains can be 0 15 or 20. For this tool to work you first need to.

FAQ Blog Calculators Students Logbook Contact LOGIN. Investments can be taxed at either long term. In the buying price and.

This is true for debt funds and FMPs. Capital Gain Tax Calculator for FY19. In the type of asset dropdown select the appropriate.

Now you can plan. Capital Gain Tax with and without Indexation. Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19.

Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment. Calculate Long Term Capital Gain LTCG tax Short Term Capital Gain Tax on sale of Shares Mutual Fund Equity Securities Calculate Taxable Value for LTCG of.

For Capital Gains made during the 20102011 Tax Year the calculation is quite complicated as the Government changed the tax scheme from 23rd June 2010. Over R60 billion in Capital Gains Tax has been collected by SARS since the inception of CGT on 1 October 2001. Capital gains tax CGT breakdown.

Note - Total profit is more than Tax Allowance 1230000 therefore Capital Gains Tax is payable.

Capital Gains Tax Calculator The Turbotax Blog

How To Calculate Capital Gains Tax H R Block

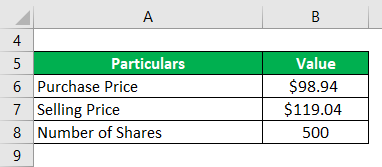

Capital Gain Formula Calculator Examples With Excel Template

Capital Gain Formula Calculator Examples With Excel Template

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

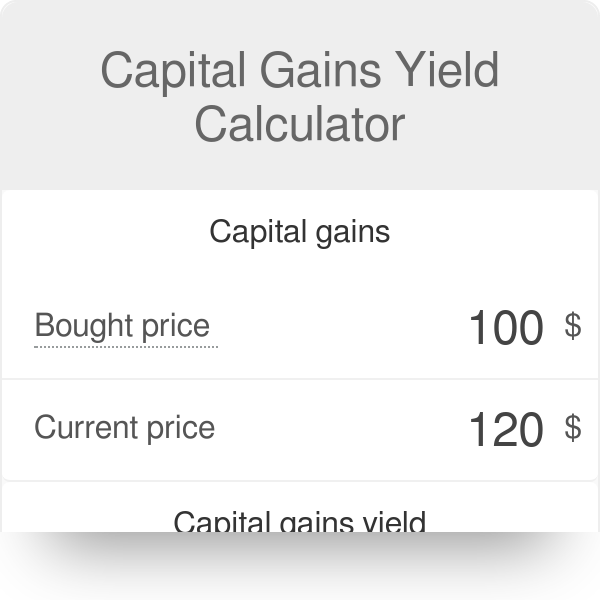

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Yield Formula With Calculator

Capital Gains Calculator With Indexation Cii Benefit Eztax

Capital Gain Formula Calculator Examples With Excel Template

Capital Gain Calculator Estimate The Tax Payable

Capital Gains Yield Calculator Calculate Price Gains

Capital Gains Calculator

Capital Gains Calculator With Indexation Cii Benefit Eztax

Capital Gains Tax What Is It When Do You Pay It

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Uk Hmrc Capital Gains Tax Calculator Timetotrade